It was a wise man indeed who first warned us to “hope for the best, but prepare for the worst.”

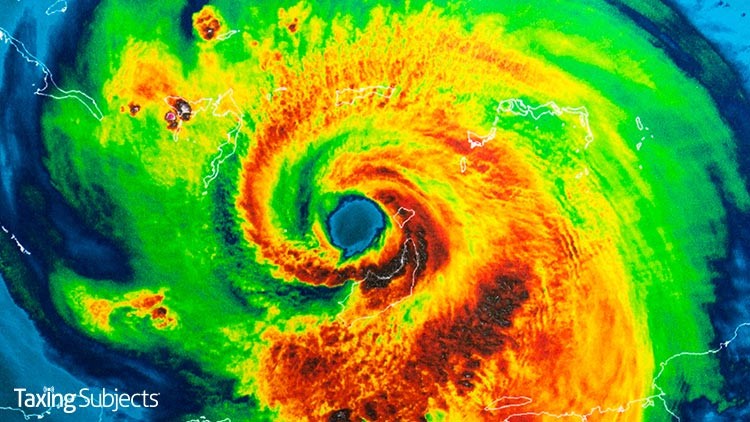

The Internal Revenue Service is following in those footsteps by reminding taxpayers that spring begins a very active period for weather in the U.S. In light of that, May includes both National Hurricane Preparedness Week and National Wildfire Awareness Week.

It shouldn’t be a surprise that reviewing emergency preparedness plans makes a lot of sense right now.

For those who like to think “it can’t happen here,” the Federal Emergency Management Agency (FEMA) knows it can. In the past year, FEMA declared major disaster areas stemming from hurricanes, tropical storms, tornadoes, severe storms, flooding, wildfires, and an earthquake.

That’s why there’s no time like the present for individuals, organizations, and businesses to come up with an emergency plan or update the one they already have.

In case of natural disaster …

The key to getting through any natural disaster is the ability to think ahead—before there’s trouble. How would an individual taxpayer or business be able to recover after a disaster? What documents would they need if their files were missing, damaged, or destroyed by the weather event?

Recovery can depend on the individual or business taxpayer’s ability to produce documentation proving insurance claims, qualifying for disaster grants and other relief.

The IRS has some tips that can help taxpayers to recover quicker economically if they are hit by a natural disaster.

Secure key documents

The story of our lives is written in the vital documents we keep. That’s why taxpayers need to keep original documents such as tax returns, birth certificates, deeds, titles and insurance policies inside waterproof containers that are in turn kept in a secure space.

Duplicates of these documents should be kept in a separate location other than the taxpayer’s home or business. Another option is to scan them and copy the data onto electronic storage media such as a flash drive.

Reconstructing records after a major disaster might be required for tax purposes, to get federal assistance or to receive insurance reimbursement. Those who have suffered partial or total loss of their records should go online to the IRS’ Reconstructing Records webpage as a first step in the process.

Document your valuables and equipment

Once the weather event is over, home- or business-owners will need some way to back up their claims for insurance or tax breaks. The best way is to record all property beforehand, but especially any expensive or high-value items. Whether it’s a simple list, a spreadsheet, or a video record, the compilation should be kept with the important documents and a copy kept off-site as well.

Publication 584 has IRS disaster-loss workbooks that can help taxpayers and businesses assemble their lists of personal property or business equipment.

Fiduciary bonds for employers

Business owners have more to think about than just protecting their documents in the event of a natural disaster. If they use a payroll service, employers should follow the IRS’ advice and ask their payroll provider if it has a fiduciary bond in place.

The bond could offer the employer a layer of protection if the payroll service defaults.

The IRS urges all employers to choose their payroll service providers carefully.

How can the IRS help?

When FEMA declares a location to be a federal disaster area, the IRS can postpone specific tax filing and payment deadlines for those taxpayers who either live or have a business in the disaster area.

Such relief is automatic; there’s no need to call the IRS and request it. The agency can identify qualified taxpayers by their address of record and applies the stated relief when processing the return.

Anyone impacted by a disaster who has tax-related questions can call the IRS at 866-562-5227 to connect to an IRS specialist trained to handle disaster-related issues.

If a taxpayer suffered an impact from a disaster but didn’t live within the federally declared disaster area, they can call the same number, 866-562-5227, to see if they qualify for disaster tax relief or other options.

Complete disaster assistance and emergency relief details are available for both individuals and businesses on the IRS’ Around the Nation webpage on IRS.gov.

FEMA’s Prepare for Disasters webpage includes information to Build a Kit of emergency supplies.

Here are some other disaster preparedness sites that may prove useful:

Source: As hurricane season nears, IRS reminds people to prepare for natural disasters